Abdullah Usman

Tax season is like Black Friday for accounting firms – it’s the make-or-break period that can define your entire year’s revenue. While your competitors are scrambling to update their websites in March, smart accounting firms start their Local SEO preparation months in advance. After working with over 200 professional service businesses in my 8 years of providing SEO services, I’ve seen firsthand how the right local SEO strategy can increase a firm’s seasonal bookings by up to 340%.

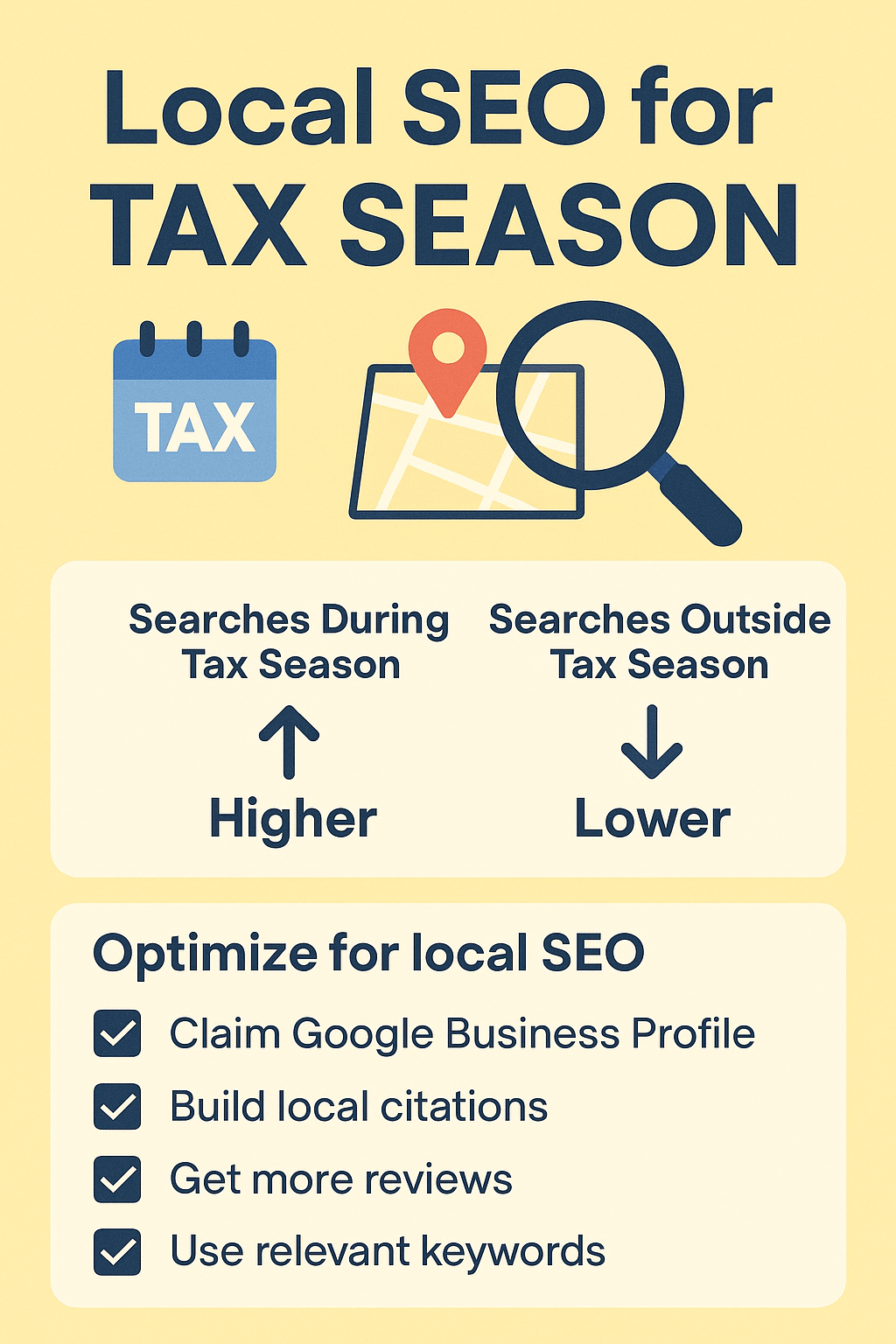

Here’s the reality: 97% of people search online for local businesses, and 46% of all Google searches are looking for local information. During tax season, this number skyrockets as stressed individuals and business owners frantically search for “tax accountant near me” or “CPA in [city name].” The question isn’t whether your potential clients are searching – it’s whether they’re finding you or your competitors.

Why Local SEO Becomes Critical During Tax Season

Tax season creates a unique search behavior pattern that savvy accounting firms can capitalize on. Unlike other professional services that maintain steady search volumes year-round, tax-related searches experience dramatic spikes. Google Trends data shows that searches for “tax preparation” increase by 400% between January and April compared to off-season months.

During this period, search intent becomes highly localized and urgent. People aren’t just looking for general tax advice – they want someone they can visit in person, trust with their sensitive financial information, and access quickly. This creates a perfect storm for local SEO dominance, but only if you’ve laid the groundwork properly.

The competition during tax season is fierce. Large chains like H&R Block and Jackson Hewitt spend millions on advertising, but they can’t match the personal touch and local expertise that smaller firms offer. This is where strategic Local SEO implementation becomes your competitive advantage, allowing you to outrank bigger competitors in your specific geographic area.

What Makes Tax Season SEO Different from Regular Local SEO

Tax season SEO operates under different rules than standard local business optimization. The search volume is concentrated into a narrow timeframe, user intent is extremely high, and the competition temporarily intensifies. Understanding these dynamics is crucial for developing an effective strategy.

Seasonal search patterns create opportunities that don’t exist during the rest of the year. Keywords that might be too competitive normally become accessible when you focus on local modifiers and seasonal terms. For example, “tax preparation downtown Phoenix” might have manageable competition compared to the broader “tax preparation” keyword.

The urgency factor also changes user behavior significantly. During tax season, people are more likely to call immediately, book appointments online, or visit your office the same day they find you. This means your Local SEO efforts have a more direct and measurable impact on revenue compared to other industries where the sales cycle might be longer.

Your SEO audit during this period should focus heavily on local ranking factors, mobile optimization, and conversion elements since most tax season searches happen on mobile devices with immediate action intent.

How to Optimize Your Google Business Profile for Maximum Tax Season Visibility

Your Google Business Profile is the cornerstone of your tax season Local SEO strategy. During peak season, this profile becomes your digital storefront, and optimizing it correctly can mean the difference between a booked calendar and watching clients go to competitors.

Start by ensuring your business hours reflect your tax season availability. Many accounting firms extend their hours during tax season, and updating this information helps Google serve your business to people searching during evening hours or weekends. Include specific tax season messaging in your description, such as “Extended hours during tax season – appointments available evenings and weekends.”

Categories play a crucial role in tax season visibility. Your primary category should be “Accounting Services” or “Tax Preparation Service,” but don’t overlook secondary categories like “Financial Consultant” or “Bookkeeping Service.” These additional categories help you appear in related searches and capture clients who might not know exactly what type of professional they need.

The posts feature becomes particularly powerful during tax season. Regular posts about tax deadlines, new tax law changes, or seasonal tips keep your profile active and provide fresh content for Google to index. Posts with images receive 40% more engagement, so include relevant visuals like tax forms, calculator images, or photos of your team working.

Strategic Keyword Research for Tax Season Success

Effective tax season keyword research goes beyond obvious terms like “tax preparation” or “CPA.” The real opportunities lie in long-tail keywords that capture specific user intent and local modifiers that connect you with nearby searchers.

Start with seasonal keyword variations that reflect how people actually search during tax season. Terms like “last minute tax filing,” “tax extension help,” or “small business tax preparation” often have lower competition but high conversion potential. These keywords naturally incorporate into your content strategy and On Page SEO efforts.

Geographic modifiers are essential for local domination. Research how people refer to your area – they might search for neighborhood names, nearby landmarks, or ZIP codes rather than just the city name. For instance, if you’re in Houston, people might search for “tax accountant Galleria area” or “CPA near Medical Center.”

Industry-specific keywords capture different client segments. “Restaurant tax preparation,” “contractor tax services,” or “rental property tax help” target business owners with specific needs. These semantic SEO approaches help you rank for qualified traffic that’s more likely to convert into high-value clients.

Don’t forget about question-based keywords that align with common tax season concerns. “How much does tax preparation cost,” “what documents do I need for taxes,” or “can I still file if I’m missing a W-2” represent opportunities to create helpful content that builds trust while improving your search visibility.

Local Content Marketing That Actually Converts During Tax Season

Content marketing during tax season requires a delicate balance between being helpful and establishing your expertise without giving away so much free advice that people don’t need to hire you. The goal is to demonstrate your knowledge while creating content that naturally incorporates your target keywords and drives local traffic.

Create location-specific tax guides that address local tax considerations. Every city and state has unique tax situations – local business license requirements, city-specific deductions, or regional industry considerations. A piece titled “2024 Tax Guide for Phoenix Small Business Owners” naturally incorporates local keywords while providing genuine value.

Develop content around common tax season pain points with local solutions. Articles like “What to Do If You Can’t Find Your Tax Documents in Arizona” or “How Denver Business Owners Can Maximize Their 2024 Deductions” address specific problems while positioning your firm as the local solution.

Use real client examples (with permission and anonymized details) to illustrate tax strategies. Case studies like “How We Saved a Local Restaurant Owner $8,000 in Taxes” provide social proof while naturally incorporating industry and location keywords. These stories make your expertise tangible and relatable to potential clients.

Create seasonal content calendars that align with tax deadlines and planning periods. Start publishing tax season content in December, ramp up in January and February, and maintain momentum through the April deadline. This sustained approach helps build topical authority and keeps your website fresh for search engines.

Technical SEO Essentials for Tax Season Traffic Surge

Tax season brings dramatic traffic increases that can overwhelm unprepared websites. Your technical SEO foundation needs to handle this surge while maintaining fast loading times and good user experience. Page speed becomes critical when stressed taxpayers are searching for immediate help.

Mobile optimization takes on extra importance during tax season since 65% of tax-related searches happen on mobile devices. Your website needs to load quickly on smartphones, display properly on small screens, and make it easy for people to call or request appointments. Google’s mobile-first indexing means poor mobile experience directly impacts your rankings.

Schema markup for local businesses becomes particularly valuable during tax season. Implement LocalBusiness schema with your operating hours, contact information, and service areas. Add specialized schema for professional services and consider event markup for tax season workshops or seminars you might offer.

Site architecture should guide visitors efficiently toward conversion actions. Create clear pathways from blog content to service pages, make contact information prominent, and ensure your appointment booking system can handle increased volume. Internal linking structure should connect related tax topics while distributing page authority throughout your site.

Don’t overlook the importance of SSL certificates and site security, especially for accounting firms handling sensitive financial information. Security issues can torpedo your SEO efforts and destroy client trust when they need it most.

Building Local Citations and Authority for Accounting Firms

Local citations act as votes of confidence in your business’s legitimacy and local presence. For accounting firms, these citations carry extra weight because financial services require high trust levels. Your Off Page SEO strategy should focus on quality citations from relevant, authoritative sources.

Start with the fundamental citation sources that every local business needs: Google Business Profile, Bing Places, Apple Maps, and major directories like Yelp and YellowPages. Ensure your business name, address, and phone number (NAP) are identical across all platforms. Inconsistent information confuses search engines and can hurt your local rankings.

Industry-specific directories provide more targeted citation opportunities. Platforms like CPA Directory, Find-a-CPA, or local chamber of commerce listings carry more weight for accounting firms than general business directories. These specialized citations signal to search engines that you’re a legitimate professional in your field.

Local business associations and professional organizations offer citation opportunities that competitors might overlook. Membership in your local CPA society, chamber of commerce, or business improvement district can provide high-quality backlinks and citations that boost your local authority.

Press releases about tax season services, new office locations, or community involvement create citation opportunities while building brand awareness. Local media outlets often need expert sources during tax season, positioning you as the go-to local authority while earning valuable media mentions.

Measuring Success: Tax Season SEO Metrics That Matter

Tracking the right metrics during tax season helps you understand what’s working and optimize your strategy for maximum impact. Revenue-focused metrics matter more than vanity metrics like total website visits when you’re dealing with a concentrated earning period.

Local search ranking positions for your target keywords provide the foundation for all other metrics. Track rankings for terms like “tax preparation [your city],” “CPA near me,” and industry-specific keywords relevant to your client base. Use tools that track local rankings specifically, as these often differ from general search results.

Google Business Profile metrics offer insights into local search performance. Monitor views, calls, direction requests, and website clicks through your profile. During tax season, you should see significant increases in all these metrics if your optimization efforts are working.

Conversion metrics tell the real story of your SEO success. Track phone calls, appointment bookings, contact form submissions, and ultimately, new client acquisitions that can be attributed to organic search traffic. Use call tracking numbers and UTM parameters to connect SEO efforts directly to revenue.

Don’t forget to measure the quality of traffic, not just quantity. Tax season brings many browsers and information seekers, but you want visitors who become clients. Monitor metrics like time on site, pages per session, and bounce rate to ensure you’re attracting qualified prospects.

Action Plan: Implementing Your Tax Season Local SEO Strategy

Your tax season SEO success depends on systematic implementation and consistent execution. Start your preparation at least three months before tax season begins – waiting until January is too late to build the authority and optimization needed for peak performance.

Begin with a comprehensive SEO audit of your current local presence. Evaluate your Google Business Profile completeness, citation consistency, website technical performance, and existing content relevance. Identify gaps in your local SEO foundation that need immediate attention.

Develop your keyword strategy and content calendar simultaneously. Map seasonal keywords to specific pages and plan your content publication schedule to build momentum as tax season approaches. Create evergreen content that works year-round while developing seasonal pieces that capture tax season traffic.

Implement technical optimizations that improve site performance and user experience. Focus on mobile optimization, page speed improvements, and clear conversion pathways. These technical elements support all your other SEO efforts and become critical during high-traffic periods.

Execute your content marketing and citation building campaigns consistently. Regular publication schedules and systematic citation building create sustained SEO momentum rather than last-minute scrambles. Monitor your progress weekly and adjust tactics based on performance data.

The difference between accounting firms that thrive during tax season and those that struggle often comes down to preparation and systematic execution. Your Local SEO strategy should start months before your busy season and continue year-round to maintain the authority and visibility that drive sustainable growth.

Remember, tax season is a marathon, not a sprint. The firms that build consistent Local SEO practices and maintain their optimization efforts throughout the year are the ones that dominate when it matters most. Your potential clients are searching – make sure they find you first.